New FlexNote SPV

FlexNote is our new SPV structure designed to simplify investing. With no tax filings, no K-1 requirements, and reduced costs, it’s everything you love about SPVs—streamlined.

Why You'll Love FlexNote

- Less Expensive

- No K-1s Required

- No exit Fees

- No Activity Fees

FlexNote vs. Standard SPV

| What's included? | Standard SPV | FlexNote SPV |

|---|---|---|

| Formation | ||

| Investor Onboarding | ||

| Consolidated Portfolio Monitoring | ||

| Tax Filings and K-1s required | Yes | No |

| Base Fee | $5,500 | $4,500 |

| Form D Filing | $1,000 | $1,000 |

| Blue Sky Filings | $500 | $500 |

| Activity fees (capital calls, distributions, transfers after Year 1) | $1,500 | Included |

| Exit | $5,000 | Included |

| Life Time SPV Cost | $13,500 | $6,000 |

Ready. Set. Fund.

Formation

Build your next successful SPV

With Venture360, access standardized documents, enjoy hassle-free entity formation, and maintain total control at all times.

Funding

Investor Relations & Funding

Our service team streamlines the onboarding process by setting up investor accounts while our software performs continuous AML compliance monitoring. Expert assistance is always available.

Closing

Integrated Deal Closing

Venture360 offers an integrated closing process, covering document execution, capital call and management fee invoice issuance, and status tracking to keep deals moving.

Tracking

Portfolio Tracking

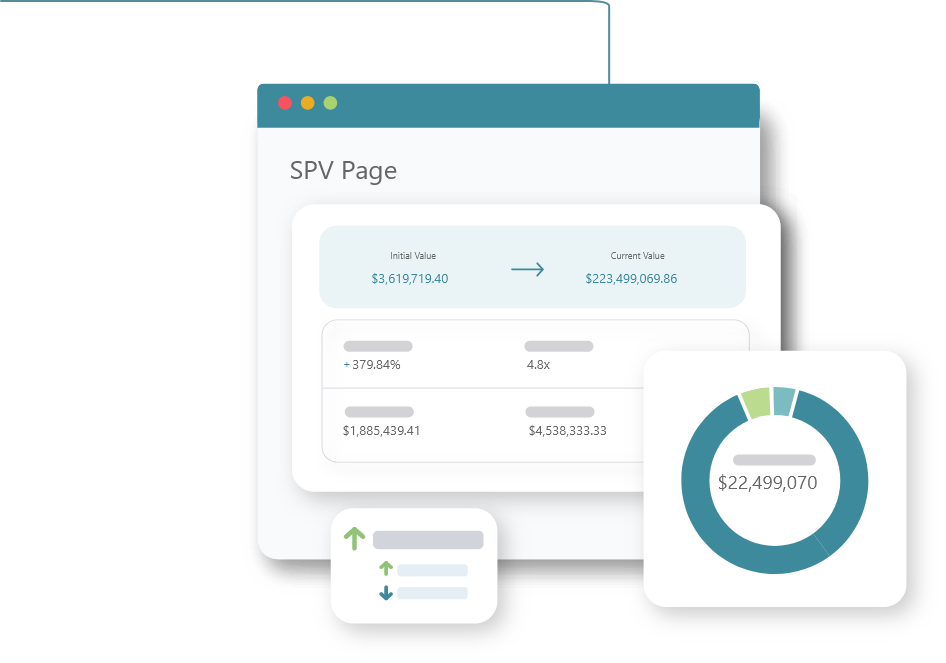

Gain full control of your portfolio. Track investments, monitor performance, and automatically report information to investors effortlessly.

Reporting

Automated Reporting

We streamline reporting by offering on-demand access to real-time capital accounts. SPV management is streamlined with tax prep, filing, and K-1 distributions all handled by our expert team.

Service Breakdown

Set up your next SPV with Venture360 and enjoy an easy, streamlined experience.

| Services | Venture360 White Glove Service | Client responsibility |

|---|---|---|

| SPV Formation Documents | ||

| BOI Reports Filed | ||

| Annual Tax Filings | ||

| Distribute K-1s to Investors | ||

| Form D (New!) and Blue Sky filings | ||

| Investor profiles created with self-certified accreditation | ||

| KYC/AML | ||

| EIN Registration | ||

| Documents sent to Investors to sign | ||

| Add portfolio company information, closing docs, etc. to V360 for seamless tracking | ||

| Capital calls | ||

| Manage investor funds coming in and wire to portfolio company |

FAQ

How is a FlexNote Different from Traditional SPV?

In a traditional SPV, investors invest capital for a % ownership in the SPV. That capital is then invested into an underlying asset that the investors own pro-rata. SPVs are typically LLCs (or a series within an LLC) that is registered with an EIN (employer identification number). The IRS expects a tax return from any EIN unless it is a disregarded entity, which traditional SPVs are not, so these SPVs are required to file a tax return and distribute K-1s to their investors every year. This results in active investors receiving hundreds of K-1s every year prompting expensive and time consuming tax prep work. SPVs are non-operating companies and hold the asset until there is an exit and distribution to the investors.

In a new FlexNote SPV by Venture360, the investors put capital into the SPV using a convertible note. This means they loan the SPV money to make the investment into the underlying asset. This loan is secured by the underlying asset, but the investors don’t own part of the SPV until conversion. When the asset has a liquidating event (loss or gain) the investors then convert to owners and reap the full benefits of the exit as if they had owned the asset from day one. Because the investors are not owners of the SPV and the only owner of the SPV is the manager, the SPV is a disregarded entity for tax purposes. For disregarded entities no tax return is required and no K-1s need to be distributed until the conversion event, which will result in a final tax return and K-1 distribution to the investors.

What is a convertible note?

A convertible note is a type of short-term debt instrument. It is essentially a loan that can be converted into equity (ownership shares) in the company at a later date.

How are management fees paid?

What triggers a conversion?

What happens when the note converts?

Do I get the full return on the investment?

Does the convertible note pay interest?

At conversion, are the gains considered short or long term?

Why do FlexNotes not require tax filings or K-1 distributions?

Can I still take advantage of investing in companies who qualify for QSBS in a FlexNote SPV?

Do FlexNotes require Form D and Blue Sky filings?

What kinds of SPVs is this NOT appropriate for?

I'm ready to speak

with an expert